Thought of the week – Digging through the 2023 forecasts

It’s that time of year again - when there are so many publishers of 2023 economic forecasts that it can be difficult to know where to start or how to assimilate everything. Thankfully I’ve come across a very useful summary of the 2023 forecasts from different bulge bracket banks in the highly recommendable free blog Beyond the Balance Sheet here.

I have quoted the relevant excerpts below with our own view in comparison in bold (where applicable). But before I do this, here is our view in comparison to Bloomberg consensus for FTSE 100 and Stoxx Europe:

FTSE 100: BBG consensus +0.6%, most optimistic: Citi with +11%, most pessimistic: T&D Asset Management with -15.4%, Liberum: +2.9% (about 1% above Goldman and Barclays which have the closest forecasts to ours)

Stoxx Europe 600: BBG consensus +0.1%, most optimistic: ING with +8.7%, most pessimistic: TFS Derivatives with -22.9%, Liberum: +7.3% (about 1% above Berenberg which has the closest forecasts to ours)

Next, let’s look at the blog post I mention above. Here are some interesting excerpts. Please note, all summaries of company views are taken from the blog mentioned above and are not created by me. What follows is an extensive quote from the blog:

Barclays

The macro environment is not encouraging heading into 2023. There is no end in sight to the war in Ukraine. Europe faces further energy headaches next year. China is growing almost as slowly as in pandemic-affected 2020. US housing activity has collapsed. And inflation has forced Western central banks into a dizzyingly fast pace of hikes. Three themes are front of mind for Barclays Research analysts:

1. Next year will be a long, hard slog

2023 may well be one of the slowest years for global growth in decades. Barclays analysts expect the world to grow at 1.7% next year. We largely agree with this view.

2. Major central banks will remain restrictive even as economies contract.

The data that really matter are not cooling quickly enough, despite the latest CPI report, and they emphasise that a pause is not a pivot. We agree here too.

3. Barclays Research analysts are negative on risk assets, for a fourth straight quarter

US stocks tend to bottom out 30-35% below peak in the middle of a recession. That suggests fair value of 3200 on the S&P500 sometime in H123. European valuations look more reasonable, but that is offset by a considerably worse macro outlook than in the US. We largely agree though we expect the trough in markets in late Q1 so a little bit earlier than Barclays.

Morgan Stanley IM

This is not the sellside powerhouse but there is some genuinely useful material here, particularly from Counterpoint Global:

Impact of a higher cost of capital on the competitive landscape:

“With the days of easy money behind us (for now), we expect fewer market entrants and less competition, which should benefit companies that have already established valuable businesses and brands.” We agree with this view.

“Stock-based compensation plans have been a low-cost funding mechanism for emerging and innovative businesses. Given the recent drawdown, we are monitoring whether companies will increase the use of cash compensation and any subsequent impact on profitability and dilution”. Our accounting specialist Prof. Ken Lee will shortly weigh in on this topic

I thought these were two important, second order thinking, points. They are obviously in opposite directions, which seems to be a characteristic of the 2023 outlook – there are often forces pulling in different directions which clouds the outlook.

MSIM flags two bullish signals:

1. Broader breadth in the S&P 500 (as illustrated by the equal weighted index (-11%) outperforming the S&P 500 market cap weighted (-17%). This implicitly says that small and mid caps will outperform large caps in the S&P 500 and is consistent with our view. However, we are far more optimistic about returns for the S&P 500 than Morgan Stanley IM insofar as we would expect the S&P 500 to be roughly sideways to slightly down.

2. Sectoral leadership: financials, industrials and materials have performed well while brokers and banks have been ok, suggesting the market is bullishly inclined. We disagree on the sector preferences and would go for consumer discretionary and in particular housebuilders in the US as well.

The stock market is the most reliable prediction tool and this positive market bias is important to note.

They expect the US economy to be very resilient and earnings to drip down slowly, frustrating the bears. We largely agree insofar as we expect US earnings to drop much less than European or UK earnings.

They like companies with pricing power and recurring revenues – high quality compounders – consumer brands, software, healthcare. They have seen valuation compression. We agree on consumer brands, not so much on software and healthcare.

The main risk is earnings. “However, with forward earnings expected to rise over the next year and margins close to record levels, we do not see earnings signalling a significant economic slowdown, let alone a serious recession.” We disagree. Our models indicate S&P 500 EPS to decline 10% or more in 2023.

Goldman Sachs

1. Global growth of 1.8% in 2023 – US resilient, Europe in mild recession, China reopens. We are more pessimistic than Goldman for the US and Europe and expect a mild recession in the US but a severe one in Europe.

2. US inflation to fall to 3%, rates to peak at 5-5.25%. We agree on peak rates but think inflation will be somewhere near 4% at the end of 2023.

3. More bullish than consensus on the US as current data not that weak, real personal disposable income rebounding, and don’t expect much more tightening to come. We agree insofar as we are also more bullish on equities than consensus.

KKR

A more constructive tilt, especially on parts of credit:

1. Equities – smaller value-oriented plays rather than larger cap tech. We agree on the smaller part, but not on the value part.

2. A weaker dollar. We agree.

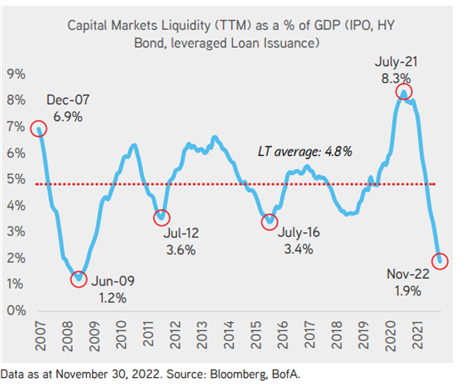

3. Capital markets new supply (i.e., new issuance), a proxy for calling bottoms, has dwindled essentially to nothing.

The chart to the left is certainly bullish – it would be interesting to see demand stats, EG corporate buybacks and retail investment into ETFs for example.

Citi Private Wealth

1. No bear market has bottomed before a recession has begun. This is an important point, although not a rule. Nevertheless they suggest you put excess cash to work. We agree.

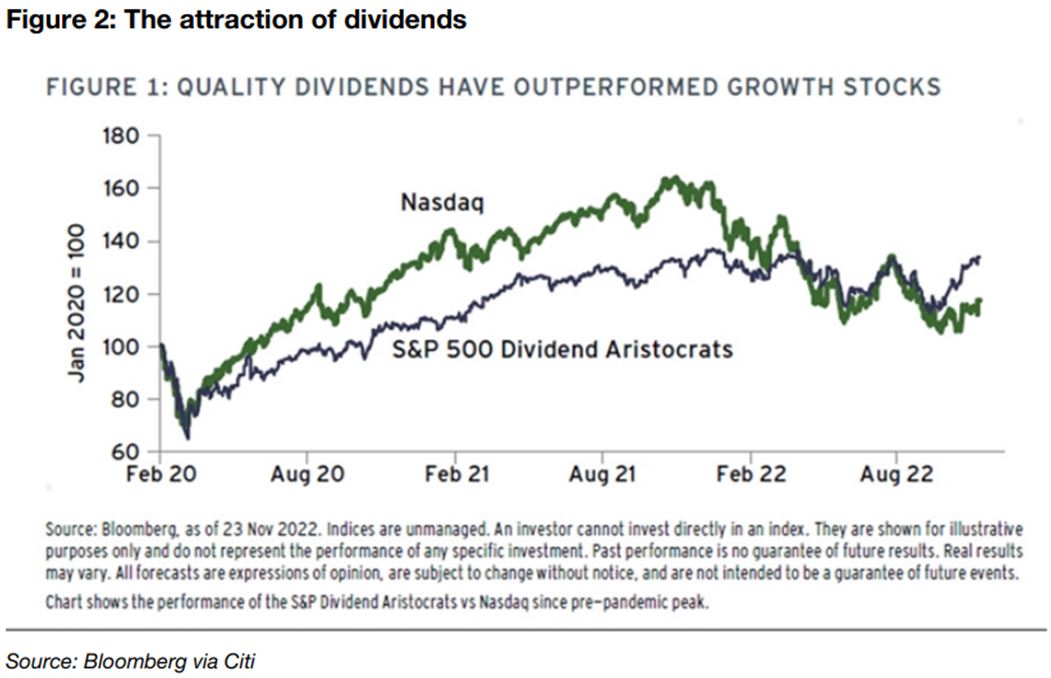

2. They like defensive equities and dividend growers (looking not only at yields but FCF cover and payout ratios). We agree with some defensives like food and tobacco as well as health care services, but dividend growers are in contradiction with our call for growth stocks.

3. They like energy transition plays, for example renewable energy technology, energy storage, electric vehicles, heat pumps, sustainable materials and carbon capture. We agree.

We all like these things, but try investing in say, carbon capture – hardly a wide range of publicly quoted options. A number of firms echo the dividend point, for obvious reasons.

UBS AM

1. Diversify beyond 60:40 with exposure to real assets and a wider selection of fixed income markets. It depends on what you call a real asset. If real assets are considered real assets, we agree, but we do not think that commodities will perform well in 2023. Within the real asset space we would focus on real estate and US TIPS.

2. Fixed income now offers positive yields. Stating the obvious.

3. Long-short strategies should provide alpha. We certainly doubt that. Long only should do just fine.

Credit Suisse

1. 2023 is likely to be challenging. Which year isn’t?

2. Diversify investments broadly. Again, stating the obvious.

3. Inflation is peaking but will remain above central bank targets. We agree.

4. In equities, they prefer sectors and regions with stable earnings, low leverage and pricing power now. We disagree. That was the theme for 2022 and we called it correctly back then. 2023 will be different and this trend is likely to end in Q1 in our view.

5. Will rotate towards interest rate sensitive sectors later (good luck with timing that!). Depends on what you think of as interest rates sensitive sectors. We certainly don’t like banks in 2023.

6. Like long duration Treasuries, EM hard currency debt and investment grade credit. We agree on long duration Treasuries and EM hard currency debt, not so much on IG credit.

7. See real estate as more challenging. We very much disagree.

Deutsche Bank

1. Easing but continued inflation and mid-single digit equity returns. We are not that optimistic for large cap equities.

2. High quality bonds have decent yields which could compensate for rate rises. We agree.

3. Earnings will not fall in nominal terms. We very much disagree. We expect S&P 500 EPS to drop >10% and UK and Europe EPS to drop by c30%.

4. They prefer cyclicals and value stocks to expensive defensives. We agree on the cyclicals but disagree on the value stocks.

5. Asia is the most attractive region. We think the UK and Europe is the most attractive region.

Here are their targets for end of 2023, some quite bullish. We are more bullish than they are on FTSE 100 and Stoxx Europe. In both of these regions they expect 0% return in 2023, which is not bullish but roughly consensus.

BNP Paribas

1. On brink of recession and equities will struggle to do well. We agree with recession part but would be more constructive on equities.

2. They prefer US growth to Europe where they’re very cautious. We agree on growth but would prefer UK growth and Europe growth over US growth.

3. Investment grade credit attractive in fixed income. We kind of disagree. There are more attractive corners in fixed income including long duration Treasuries and TIPS.

4. They also like private infrastructure debt. No view on our side.

5. Sustainable recovery is a big theme, EG green infrastructure. We agree.

6. China is cheap but rerating is unlikely

BNP are an outlier in their negativism

JP Morgan AM

1. 2023 will be a bad year for economy, but a better year for markets. We agree.

2. Inflation will moderate. We agree.

3. Stocks and bonds look attractive. We agree as far as SMID stocks are concerned, but disagree on large cap stocks.

4. They prefer value to growth. We disagree and prefer growth to value.

5. Earnings estimates only -5%, and should be -10 to -20%. We agree.

6. Stocks may fall further but they have priced in some of the likely earnings downgrades and will be higher end-2023. We agree.

Fidelity

1. Believe the deteriorating environment is not yet reflected in equities. We agree, it is only partially reflected.

2. They expect a high degree of volatility and uncertainty for global equities in 2023. This is stating the obvious.

3. Defensive areas such as financials and utilities could outperform as the economic slowdown takes hold. We disagree, we think financials will underperform.

4. Bond yields are finally starting to look attractive again. We agree.

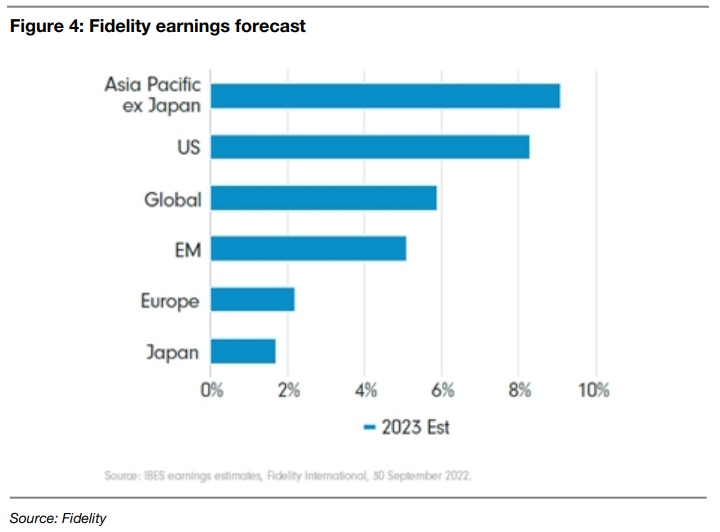

5. Consensus Earnings Forecasts. We are far more pessimistic on earnings than Fidelity.

Earnings Forecasts

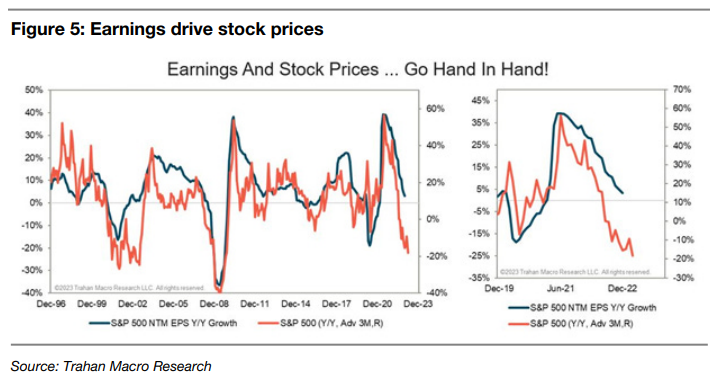

Francois Trahan points out that bear markets end when a trough in earnings (EPS) is on the horizon (left)

He flags that earnings and GDP are tightly correlated across time and thinks that we will have to wait for a recovery in the economy before we can start talking about a renewed bull market. But note that consensus is for a mild and short recession in the US.

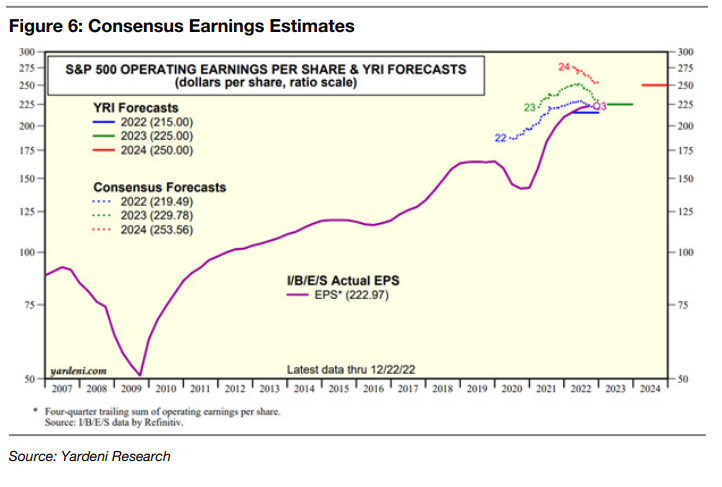

Yardeni’s data on S&P500 consensus forecasts is 219.5 for 2022, 229.8 for 2023, a 5% increase and 253.6 for 2024, a 10.3% increase. The trend is shown in the chart: We are far more pessimistic than that.

We start from record margins, and inflation will surely induce margin compression, so my instinct is to assume that these data are far too ambitious. Although past experience has exhibited a wide range of earnings outcomes in a recession. The impact of inflation on revenues, however, could result in the nominal earnings outcome being better than the napkin maths might suggest.

Persistent inflation of course would be negative for sentiment and there is quite a lot of hope riding on the Fed pivot which seems highly unlikely to this analyst.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.