Thought of the Week - The rise of shadow banking in two key charts

Most people know that after the financial crisis, banks were hit by tighter capital requirements, which has been blamed by some for the decline in bank lending. But a new study shows that (i) this decline in bank lending started much earlier, and (ii) the main driving force behind it was the rise of shadow banking.

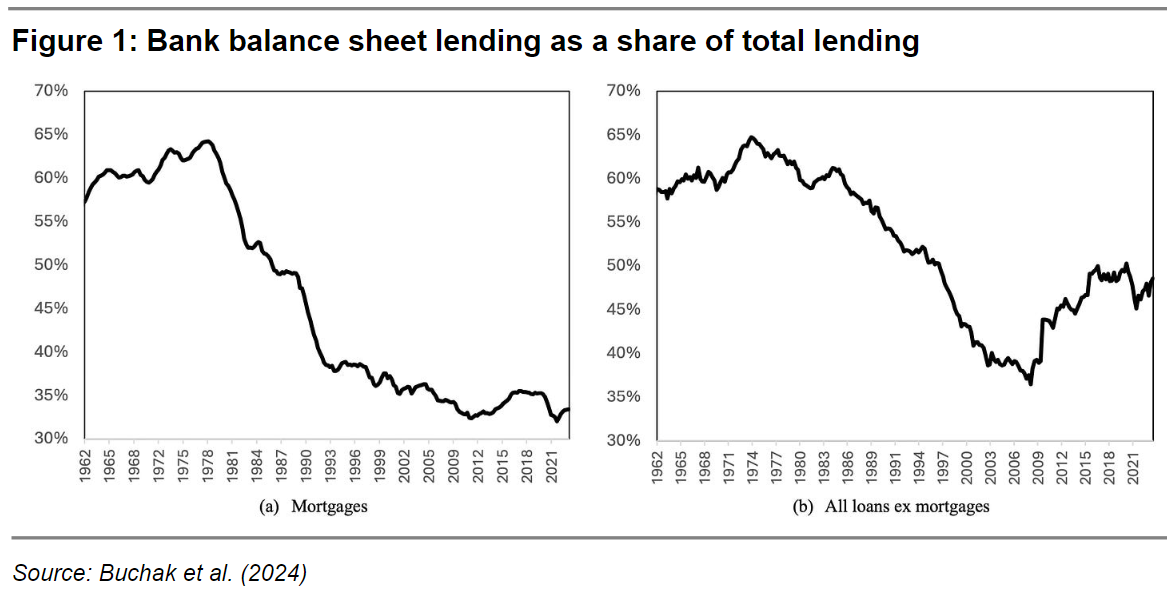

Between 1970 and 2023, the share of total loans made by US banks and recognised on their balance sheets dropped from 60% to 35%. This drop has been particularly large in the mortgage space, where mortgages backed by the US government have become available. This means that most mortgages in the US today are issued with some form of government agency backing, and banks have little incentive to issue mortgages that cannot be pushed off their balance sheets. But even if we look at bank lending ex-mortgages, we see that the share of loans held on banks’ balance sheets has dropped significantly.

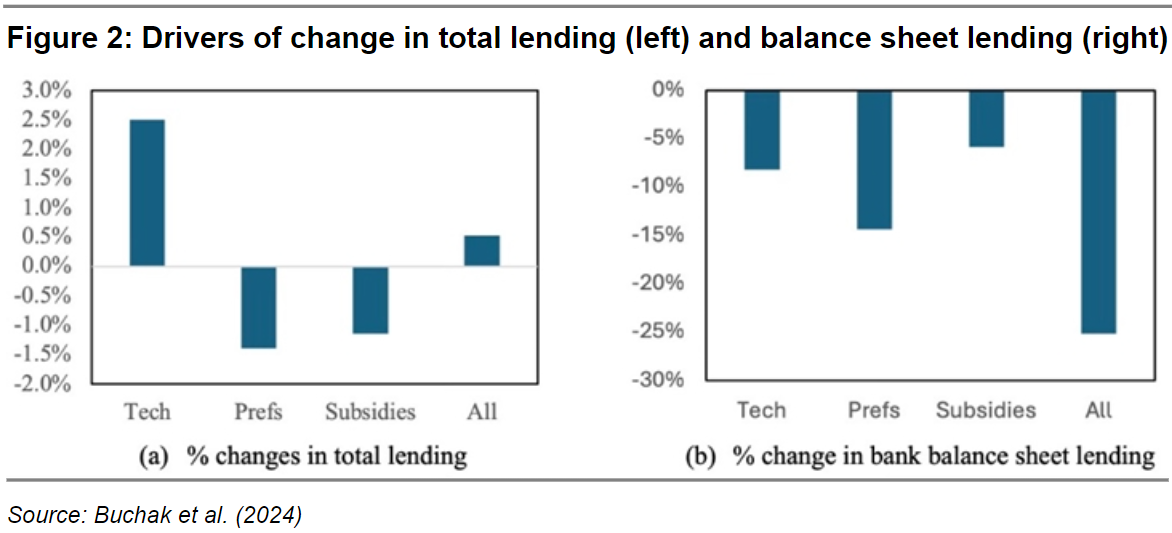

Where it gets interesting, though, is in the two charts below. They show the results of estimates in the study of what change has been driven by one of three forces:

- Technological progress in securitisation of debt and the rise of the shadow banking system.

- Changing saving behaviour by households, which have reduced bank deposits in favour of money markets and securities with a money market-like structure.

- Change in capital requirements for banks holding loans on their balance sheet.

As you can see in the left-hand chart, technological advances and the rise of shadow banking have led to an overall increase in total lending activity in the US. But less and less of that is done by banks in the form of traditional on-balance-sheet loans. Instead, about half the decline in on-balance-sheet lending has been driven by a secular decline in deposit holdings, while one-third was due to the rise of shadow banking solutions and only a small part (about a fifth) is a reaction to higher capital requirements.

This brings me to an important point that is simply not discussed enough, in my view. We are focusing so much on bank regulation and are constantly monitoring the quality of bank loans and mortgages. But more than half of all loans are now held outside of bank balance sheets and a large part of these loans is in the shadow banking system, held by hedge funds, pension funds, and others. And there is almost no regulation or oversight of these instruments. Heck, there is hardly any data available on how much of that stuff is around and where it is held. We have no idea what is going on with these loans and if there are any problems with them. The best data I know comes from chapter 2 in the IMF's recent Financial Stability Report, which shows how prevalent and leveraged private debt loans are in the US.

It feels to me like we are still trying to fight the last war of the financial crisis of 2008, while the real crisis will come from a part of the economy that is as opaque and unmonitored as any I have come across in my career.