Thought of the Week - I think I’ll never get back on the good side of MSCI ESG…

In November, I wrote a post about the finding that companies with better share price performance are more likely to be upgraded in the MSCI ESG rating system than in the Refinitiv ESG rating system. One possible explanation is that MSCI, which has a substantial business selling ESG indices, tries to boost the performance of its ESG indices.

Strangely, I didn’t receive a Christmas card from the folks at MSCI ESG after that, and I think after today’s post, I won’t get one next Christmas either…

According to a study from Bocconi University, investors who follow MSCI ESG ratings for an ESG momentum strategy might lose money, while following ESG ratings momentum from other providers may create alpha.

One of my favourite ways to exploit ESG credentials is to invest in stocks with positive and strong ESG momentum, i.e. companies that improve their ESG credentials over time. If ESG investing is a form of dealing with nonfinancial risks, then companies that improve their ESG credentials over time should not only see their ESG ratings improve but also reduce these nonfinancial risks, which in the long run should lead to fewer share price drawdowns and a lower risk premium on the share price.

In the study mentioned above, the performance of a simple ESG momentum strategy was tested: Invest in companies that have experienced the strongest upgrade in ESG scores in the past and short the companies that have experienced the largest downgrades.

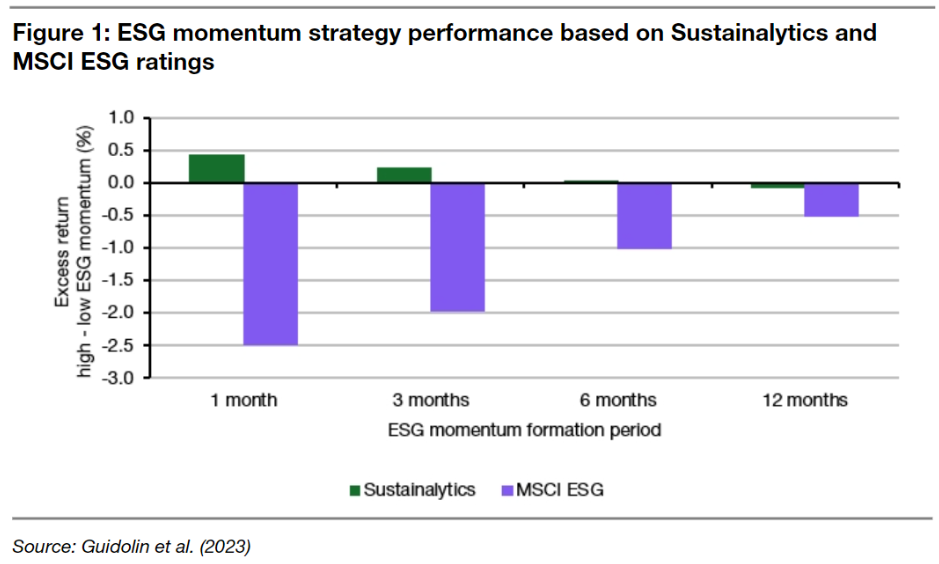

There are several ways you can define ‘strongest upgrade in the past’, and the study tested changes in ESG ratings over the last 1, 3, 6 and 12 months. The chart to the left shows the performance of the top 20% stocks with the strongest upgrades vs. the bottom 20% stocks with the strongest downgrades.

Interestingly, sorting stocks based on ESG momentum in Sustainalytics ratings (which doesn’t have a substantial index business) leads to positive excess returns. Sorting stocks based on ESG momentum in MSCI ESG ratings (which does have a substantial index business) leads to negative excess returns.

I emphasise that these findings do not prove any wrongdoing or misaligned incentives in MSCI ESG ratings, but I would say they indicate two things:

This difference in results is roughly what you would expect if MSCI biases its ESG ratings upgrades towards stocks with better past performance. Share price momentum tends to fade after about a year or two, so if a hypothetical ratings agency upgrades stocks that have high past share price momentum, they will do so after a year or so of strong performance. After the upgrade, the strong performance may continue for a couple more months but will eventually fade. Hence, ESG rating upgrades that take past share price performance into account should lead to lower and potentially negative return differentials after the upgrade.

As an investor, I think companies that improve their ESG credentials should see their performance improve over time, so seeing negative returns to an ESG momentum strategy is not something I would expect. In my work, I tend to use Refinitiv ESG ratings which, just like the Sustainalytics ratings, show positive ESG momentum results. In my view, MSCI ESG ratings are the outlier and there is something unusual about them. Hence, as an investor interested in ESG ratings that make sense and help create performance, I would ignore MSCI ESG ratings until I have a clear explanation and understanding of their methodology and use Sustainalytics or Refinitiv data instead.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.