Thought of the Week - How do businesses adopt innovations?

Disruptive changes to an existing industry seem to happen more and more often, and while some businesses seem eager to jump onto new trends early on, others try to hold out for as long as possible. A study of the American retail industry’s adoption of e-commerce and the rise of online retailing provides some interesting insights into how that disruption worked.

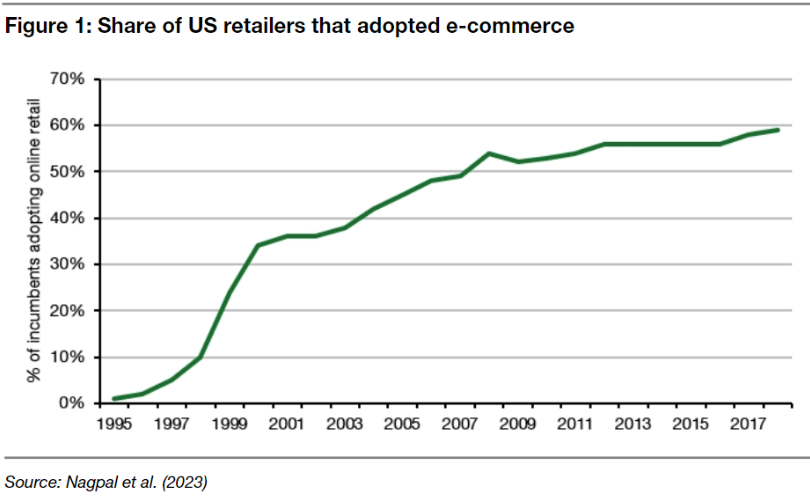

First of all, as one might expect, the penetration of e-commerce in the US retail sector follows a logistic curve with exponential growth in the first stage when the internet was young (from 1995 to about 2000). After that, adoption rates slowly dropped until we hit saturation in about 2008. Since then, there has been little change. Companies that have not yet adopted e-commerce may have a variety of reasons, but they are unlikely to do so going forward.

Note that many investors assumed in the 1990s that the exponential growth we saw back then would continue forever, something that contributed to the tech bubble. But, as always, the truth is a logistics curve that shows saturation after an initial rapid growth phase. I keep emphasising this logistics curve effect because, as I have said before, if you keep that in mind, it will prevent you from making so many costly investment mistakes.

Thought of the Day23 November 20232There are interesting insights in the study on which companies were early adopters and what convinced the later entrants to take the plunge.

First, there is enormous uncertainty around the benefits of e-commerce. Are the significant investments justified by the potential revenues or is it just going to be a fad? In this initial phase (the exponential growth phase until about 2000), companies monitored their peers. If more of their peers entered the e-commerce space, they would follow as fast as possible to avoid losing out on a potential opportunity. If their peers did not enter the e-commerce space, they would usually shy away from these investments as well. It is the usual snowball effect. One adventurous company takes the plunge and a few follow. These are followed by a few more, and pretty soon you’ve got an avalanche of new entrants in the e-commerce space.

Then, in a second phase (from about 2000 onward), companies not only monitored what their peers did but also how the industry fared in their e-commerce businesses. As more data about costs and benefits became available, companies scrutinised their decisions more closely. Interestingly, when it comes to scrutinising the outcomes of e-commerce adoption, businesses don’t typically look to their peers. What they are interested in is how the top companies in their industry fare. This provides a benchmark for what can reasonably be achieved by them. They still monitor whether their peers continue to enter the e-commerce space, but the results of the efforts of the top companies in the industry become more important.

You can see the same dynamics in place with the shift from internal combustion engines to battery electric vehicles in the car industry. In the beginning, Tesla entered the race, and German and Japanese car manufacturers all looked at each other, saw that none of their peers did anything to launch EVs, and did nothing themselves. Instead, they were focused on matching the hybrid car offering of one of their peers: Toyota.

But as Tesla became more successful and EVs more affordable, German and Japanese car makers started to introduce more EVs to get a share of the market. When they did that, it created the avalanche of companies launching new EVs that we have seen in the last couple of years, together with announcements that they will only sell EVs at some point in the future.

Today, we are probably at the phase in the adoption of EVs where saturation effects are starting to become visible. Investors who think that EV adoption will continue along the same line of exponential growth as we have seen in the last five years (i.e. everyone who believes that current Tesla share prices are correct) will likely be in for some disappointment going forward. Growth rates will fall, and car makers will likely look at the costs and benefits incurred by industry behemoths like Tesla, VW or Hyundai before they decide how to proceed with their own adoption of EVs. Adoption will increase, but the dynamics are changing. And recognising these shifts is important for both businesses and investors in every industry.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.