Thought of the Week – Cut it out

Corporate reports are getting longer and longer, and earnings calls aren’t getting any better either. As investors, we have to wade through this swamp of clutter and legal disclosures to find the actual information. Luckily, chatGPT and other LLMs can help us with that while at the same time amplifying signals that are obfuscated by clutter and legalese.

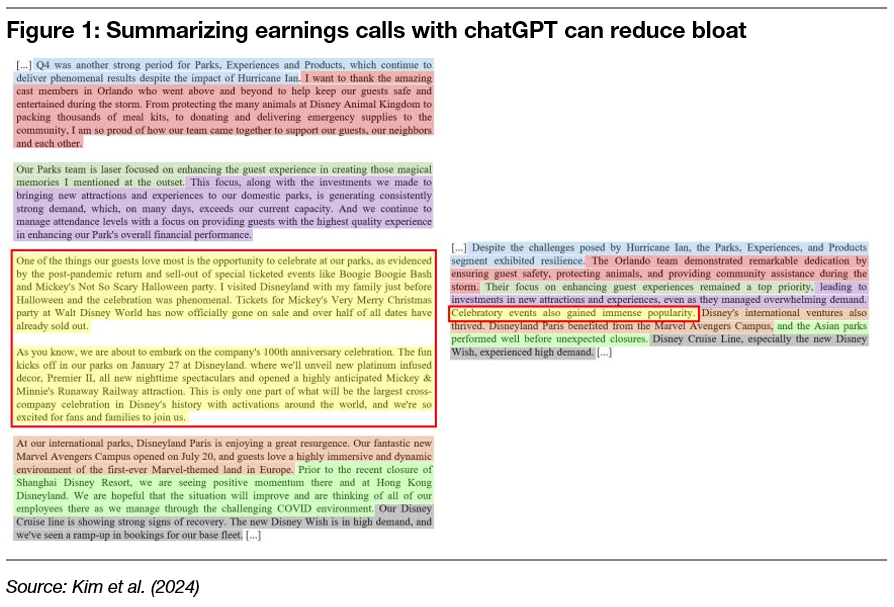

More and more analysts at my firm are using AI to save time. For example, instead of listening to a lengthy earnings call, they let an app transcribe the call and then use AI to summarise the contents. If you don’t plan to ask any questions, that can reduce the time spent on earnings calls dramatically. Take the example to the left, which shows the transcript of Disney’s Q4 2022 earnings call on the left and the chatGPT summary on the right. It’s quite a difference.

This example is taken from new research by researchers from the University of Chicago who used chatGPT 3.5 to summarise 1,790 management discussion and analysis (MD&A) sections in the annual reports of 339 US companies and a total of 8,537 conference calls.

They find that the length of the call or MD&A discussion can be reduced by 70-75% without loss of information, which gives you an idea of how much clutter there is in today’s corporate statements. But once you remove the clutter, the sentiment and information content becomes not only clearer but more pronounced. Good news gets amplified, and so does bad news. This may explain why companies try to obfuscate bad news by writing long MD&A statements. But it cannot explain why, in many instances, good news is also obfuscated by noise. This kind of clutter makes markets less efficient and reduces the impact of the information provided.

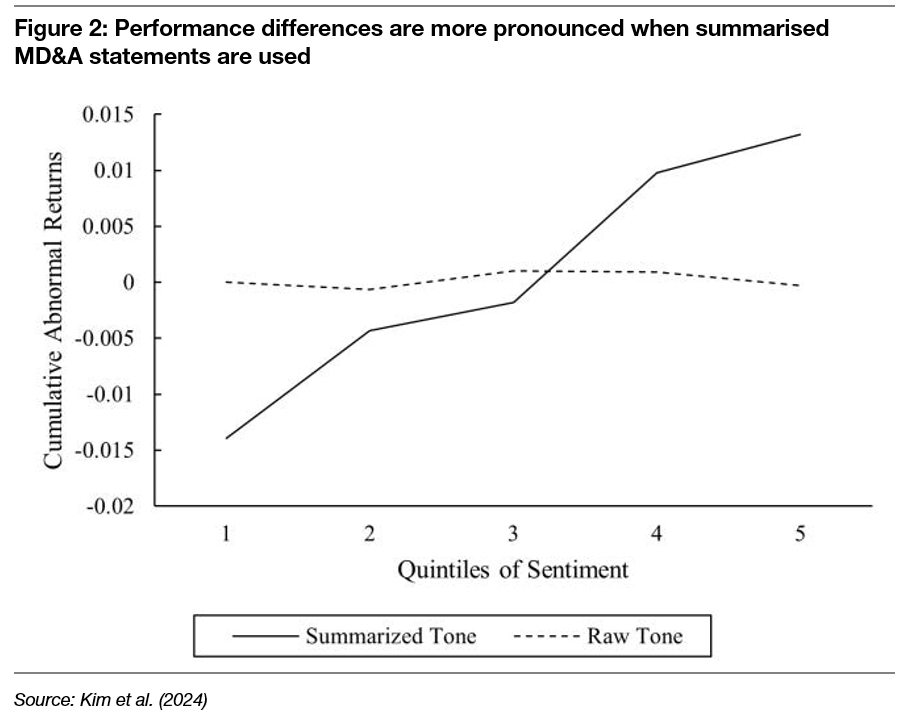

Using the summarised, compact versions of MD&A statements, the authors were able to better identify companies with positive and negative news and, as a result, saw larger performance differences between the companies they identified as presenting good vs. bad news.

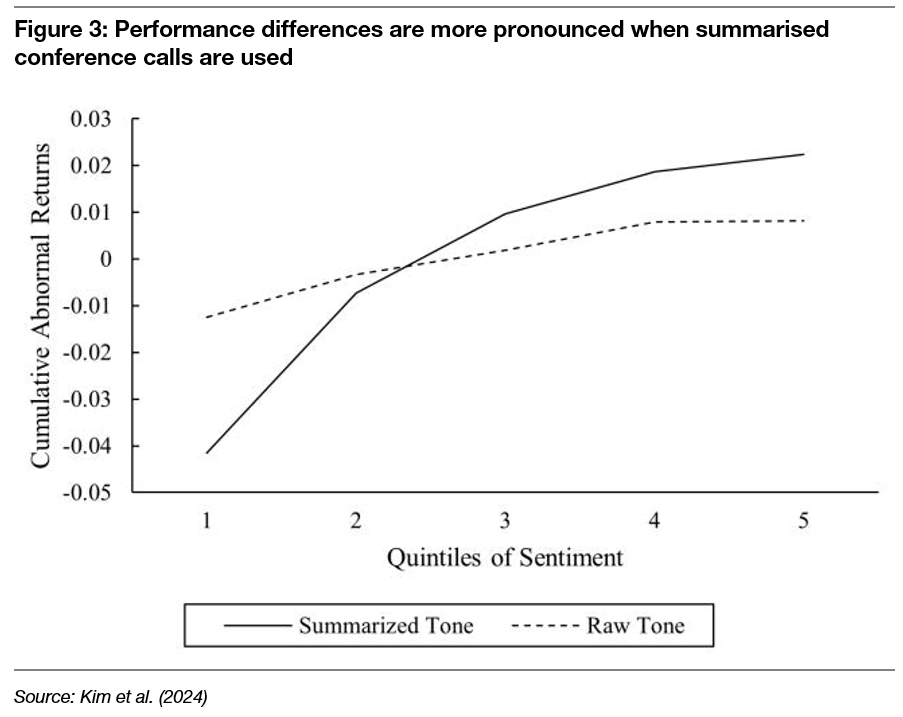

The same is true for earnings calls, where a summary of the call leads to a more pronounced difference in selecting companies with good and bad news, which, in turn, can enhance performance.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone