Thought of the Day - Engagement works

ESG investing is long past the point where it simply excluded some companies. Today, engagement with management is the name of the game. But does engagement work?

Vicente Bermejo and his colleagues tried to figure out what influence investors have on the ESG practices of companies and compared this to the influence of the company itself and the CEO of the company. This is much harder than it sounds because you need to have a complete dataset of companies, their CEOs, and their entire investor base plus the shareholder votes at AGMs on ESG issues. Starting with the companies in the US covered by MSCI ESG, they collected this data for some 5,300 companies with some 7,700 CEOs and some 7,500 large institutional investors between 1992 and 2018.

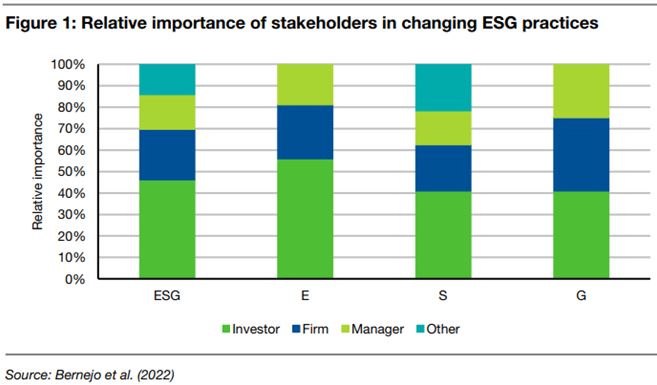

Based on that data, they could examine how much of the variation in ESG practices between firms is due to investors and other important stakeholders. The relative importance is shown in the chart below and the good news is that some 40% to 50% of the variation in ESG practices is driven by investors engaging with the company. That is typically more than the influence of the CEO and the company itself. In other words: engagement works.

Without investors pushing for change, companies would be much more lethargic in improving their ESG credentials. The only area of ESG where companies seem to be doing fine on their own is the governance area. In the environmental and social dimension companies need to be pushed by investors to do something.

Ironically, when pushed by investors through engagement or votes on ESG topics at shareholder meetings, companies do change their business practices and that has benefits for the company and its shareholders. The research by Vicente Bermejo shows that once companies improve their environmental and social business practices, risks in these areas drop. Corporate management may think it only increases admin work and costs but what these initiatives really do is save costs in the form of lower risks and fewer losses for shareholders.

Thus, to all investors, I say: keep engaging. You are doing the right thing and you are making a difference.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.